Leverage Cutting Edge Tech in 2023 for Your IT Business

January 17, 2023

At C4, we know that if you’re not playing an infinite game, you risk becoming irrelevant. We can…

Are you wondering what your MSP business is worth or how you can value your MSP business from a potential buyer’s perspective? You might be approaching retirement age and thinking about your options to sell or exit. Or perhaps you’re wanting to aggressively grow your business to achieve a goal in say 5 years and reach a certain MSP valuation number. Planning and following a few guidelines can help you increase the value of your MSP business before putting it up for sale.

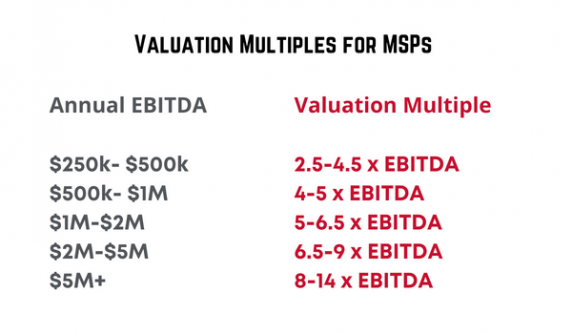

MSP valuations are typically a multiple of the 12-month trailing EBITDA considering the metrics and other business factors discussed in this article.

Most MSP owners need to be thinking about their valuation long before they’re ready to walk away. To do this, you need to start with the end in mind. What is your walkway number? It’s fine to change it later if necessary. Without this preparation, though, you could be leaving money on the table.

Customer concentration, MRR, proper financials, and tax/legal planning take time to put into place. We’ve seen deals fall apart as the seller realizes they’d like to work on these metrics for a year or so to fetch the higher multiple. Our suggestion to any MSP is to think about these things as early as possible, talk to a tax CPA and lawyer, and create a Strategic Plan or Exit Strategy.

Since due diligence often begins shortly after talks to acquire a company, it is necessary to do the following ahead of time:

Make sure you have clean financials, with proper bookkeeping and billing. In the selling process, during due diligence, buyers will be looking very closely at financials. Gather a minimum of the last three years of financial documents. A vCFO can be a great resource to prepare you financially before selling your MSP.

Make sure customer contracts are organized, up-to-date, and accurate.

Will your business still run if you step away? What systems and processes are in place? Writing out SOPs for operations, service delivery, hiring, marketing, and sales will help others to step into your place.

Don’t shy away from bragging about your business. Know your "why" and the reason you do what you do. Know your values and the story of why and how you help businesses. You are selling to a potential buyer, so being confident in your value and vision is key.

There are a few metrics that will be very important in determining the valuation of your MSP business. Buyers will use these to calculate what they believe your business is worth. By tracking these now, you can optimize your business for a higher multiple later.

Also called Earnings before Interest, Taxes, Depreciation, and Amortization.

How to Calculate:

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

This is the most important metric for your MSP business valuation and represents the profitability of your business. Typically, the higher the EBITDA, the higher the valuation, usually because the MSP business has proven its ability to scale and optimize for profitability.

Larger and more operationally mature MSPs tend to fetch a higher multiple than smaller companies that would be considered an add-on for a platform company. Companies with higher gross profit margins, lower customer churn, lower customer concentration, and higher % of sales as MRR will be at the higher end of these multiple ranges. In the current market, this is what our team at C4 Solutions is seeing in terms of valuation multiples.

Our Senior Managing Partner, Greg Banghart, added the following insights. “Multiples today are going to be lower than they have been in several years, as the cost of debt has not only gone up, but the DCR ratios that lenders require have increased, lowering the amount of leverage that can be used in a transaction. In general, more restrictive debt is going to reduce the number of buyers and reduce the selling price as the buyer cannot employ as much leverage in the purchase. With fewer buyers in the market, even buyers that do not need to borrow at today’s interest rates (equity funds and companies with cash that needs to be deployed) will not be willing to pay as much as they have in recent years.”

This metric is important to buyers as it shows the efficiency and maturity of an MSP. The higher the margin, the more profitable and attractive your business will be to a potential buyer. Focusing on increasing your margins will lead to a bigger payday. Sellers do this by offering superior service and products that command a greater price, selling to the right customers, implementing business automation, eliminating expenses, and becoming more operationally efficient. Basically, doing more with less.

At least 65% of your revenue, and ideally closer to 80% should be from recurring revenue from managed customers. How can you shift your time and energy away from a project or one-time revenue to stickier MRR?

Growth means nothing If you are losing customers through churn. That is why this metric is so critical to buyers. Your MSP should be seeing no more than 5% churn on an annual basis, so no less than a 95% retention rate. Some churn is unavoidable, when customers get acquired, etc. Some verticals will experience more churn than others, especially in volatile economic conditions. To increase retention, make sure you’re actively engaged and nurturing your current customers to get the most value out of your services. Buyers may look at retention rates for the last 3-5 years, so make sure this number is improving.

Have you been growing at a steady, predictable pace for the last 3-5 years? The higher valuation companies will show double-digit annual recurring growth. For smaller add-on companies, single-digit growth will be acceptable. If you're looking for ways to grow your MSP, check out our post here.

This really depends on how many total customers an MSP business has. If the business has 20 customers or more, the top 5 customers shouldn’t exceed 50% of the revenue. No one customer should make up more than 15% of revenue. If you’re worried that concentration might be an issue, growing your customer base and expanding into new markets with sales and marketing could help remedy this.

Do you have free cash flow in the business? Do you have a lot of debt? Are your receivables on time? What is your percentage of uncollected revenue?

The vertical that your customer base is in may be a deciding factor. Are they in a growing industry or segment? How will economic conditions affect this vertical? Does the buyer have expertise in this industry? Are there efficiencies or ways to cross-sell to this customer base?

Your people and employees will also be key. A strong management team and skilled employees make a difference. Do you have a culture that makes your employees want to stay? What makes your company a unique place to work and grow? How are your employees incentivized? What is your employee turnover rate?

The technology and services that you offer are key to an MSP business. What is the one thing you do better than most? How relevant will they be in a few years? Are you keeping up with what’s next? Are you evolving with the threats and opportunities of the current technology landscape?

Do you have any unique assets that make you stand out? Custom software or applications? Is there something you do better than anyone else? This could also increase your MSP valuation.

How relevant is the local market for your business? How relevant is your location to your buyer’s market?

Your own plan will also affect your MSP's valuation. Are you willing to stay on for a certain period to help run and transition the business? Or do you need to walk away now? Do you want to be bought out or stay for an earn-up or second bite at the apple?

Well-documented and standardized processes are essential in a well-run business. Highly integrated systems and automation with financials, hiring/HR, marketing, sales, and service delivery are optimal for the higher end of the valuation multiples.

Finding a buyer who shares your vision is also important and will result in a higher appreciation for your business and a higher valuation number.

By taking these steps to properly plan and improve important metrics, you can increase the attractiveness of your MSP business and hopefully command a higher multiple upon valuation. Demonstrating consistent, predictable, and profitable growth with low churn will help you maximize your MSP valuation.

C4 Solutions LLC is an MSP advisory firm with locations in Irvine, CA and Oxford, MS. C4 helps MSPs grow and/or sell their MSP business with custom solutions and a network of buyers/sellers. Whether you want to grow organically or through acquisition, or prepare your business to sell, our team of industry experts can help you reach your goals. Reach out today to get a free assessment.

Written by Holly Mack